American Rescue Plan Act

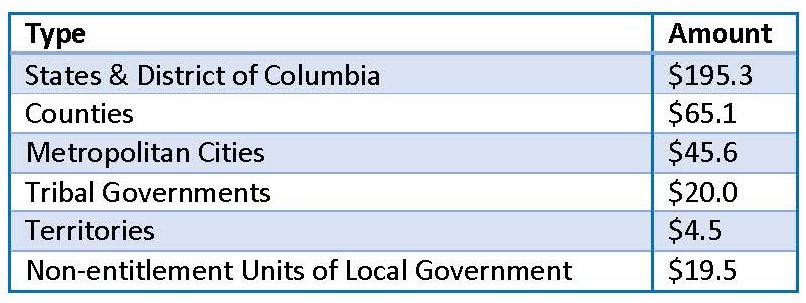

Signed into law on March 11, 2021, the American Rescue Plan Act of 2021 (ARPA) provided state, local and tribal governments $350 billion in additional funding via the Coronavirus State and Local Fiscal Recovery Funds (SLFRF) program. This program is intended to support governments in responding to the economic and public health impacts of COVID-19 throughout communities.

IN THE NEWS!

Governor Shapiro Recognizes Office Of The Budget Employees For Exceptional Management Of COVID-19 Pandemic Grant Funding - October 23. 2023

Agency Reporting Requirements:

Agency Intake Form* should be sent to Email: RA-OBSLFRF_DATA@pa.gov, upon completion.

*** NOTE: This document must be downloaded and opened in Adobe Reader or Adobe Acrobat to ensure full functionality. Your 'Expenditure Group' selection should prompt different options in the 'Expenditure Sub-category' dropdown. If this does not occur, please contact us before proceeding.

SAM.gov Registration: All entities must register with SAM.gov to receive a Unique Entity Identification (UEI) number. A UEI number is necessary to report data to US Treasury. SAM.gov | Home

SLFRF Compliance and Reporting Guidance: Recipient Compliance and Reporting Responsibilities | U.S. Department of the Treasury

Required Programmatic

Data as of August 2022

ARPA Fact Sheet for

Agencies

Contact Us/Resource Account:

PA SLFRF Resource Account

Governor's Budget Office

Email: RA-OBSLFRF_DATA@pa.gov

Covid State Fiscal Recovery ESN’s

State & Local Aid:

Of the $350 billion, Pennsylvania received $7.291 billion for counties, cities, boroughs, and townships and $983 million for Non-Entitlement Units (NEU's) to meet pandemic response needs.

All funds must be obligated by December 31, 2024, and must be expended by December 31, 2026.

Pennsylvania NEU Allocations: Pennsylvania NEU Allocations (pa.gov)

Pennsylvania Metropolitan City Allocations: Pennsylvania Metropolitan City Allocations (pa.gov)

Pennsylvania County Allocations Pennsylvania County Allocations (pa.gov)

Project Template

| Applies to the following Expenditure Categories

|

ProjectBaselineBulkUploadTemplate.xlsx

| 1.1-7, 1.10, 1.12-14, 2.9, 2.19-23, 2.28, 2.35, 2.37, 3.3-3.5, 7.1-7.2

|

Project18_229233BulkUpload.xlsx

| 1.8, 2.29-2.33

|

Project19_234BulkUpload.xlsx

| 1.9, 2.34

|

Project31BulkUpload.xlsx

| 3.1

|

Project32BulkUpload.xlsx

| 3.2

|

Project236BulkUpload.xlsx

| 2.36

|

Project2128BulkUpload.xlsx

| 2.1-2.8

|

Project4142BulkUpload.xlsx

| 4.1-4.2

|

Project51518BulkUpload.xlsx

| 5.1-5.18

|

Project111210BulkUpload.xlsx

| 1.11, 2.10

|

Project211214BulkUpload.xlsx

| 2.11-2.14

|

Project215218BulkUpload.xlsx

| 2.15-2.16, 2.17-2.18

|

Project224227BulkUpload.xlsx

| 2.24-2.27

|

Transaction Templates:

expendituresGT50000BulkUpload.xlsx

expendituresLT50000BulkUpload.xlsx

paymentsIndividualsLT50000BulkUpload.xlsx

subawardBulkUpload.xlsx

subRecipientBulkUpload.xlsx

US Treasury Report Submissions: Fiscal Recovery Reports (pa.gov)

Federal Reporting User Guidance:

Final Rule SLFRF Final Rule.pdf (treasury.gov)

Final Rule Overview SLFRF-Final-Rule-Overview.pdf (treasury.gov)

Recovery Plan Reporting User Guide SLFRF Recovery Plan User Guide - July 2022 (treasury.gov)

Approved Capital Expenditures as of August 2022

Expenditure Categories as of August 2022

SLFRF Frequently Asked Questions as of July 2022

US Treasury Reporting Webinars

U.S. Census Data

Median Household Income of the service area

Lowest Quintile Income of the service area

Legislation and Related Statutes:

2022 Fiscal Code.pdf

American Rescue Plan Act of 2021.pdf